Property investments are not what you think

My analysis of a reader's real estate investment

An Instagram follower sent me a DM about an investment property, asking if it’s a good investment. In his mind, the property is “cashflow positive from the start”. So it sounds like the dream scenario where you’re using the bank’s money to build a property portfolio. In my experience, though, it’s usually not that straightforward, which led me down the rabbit hole to follow.

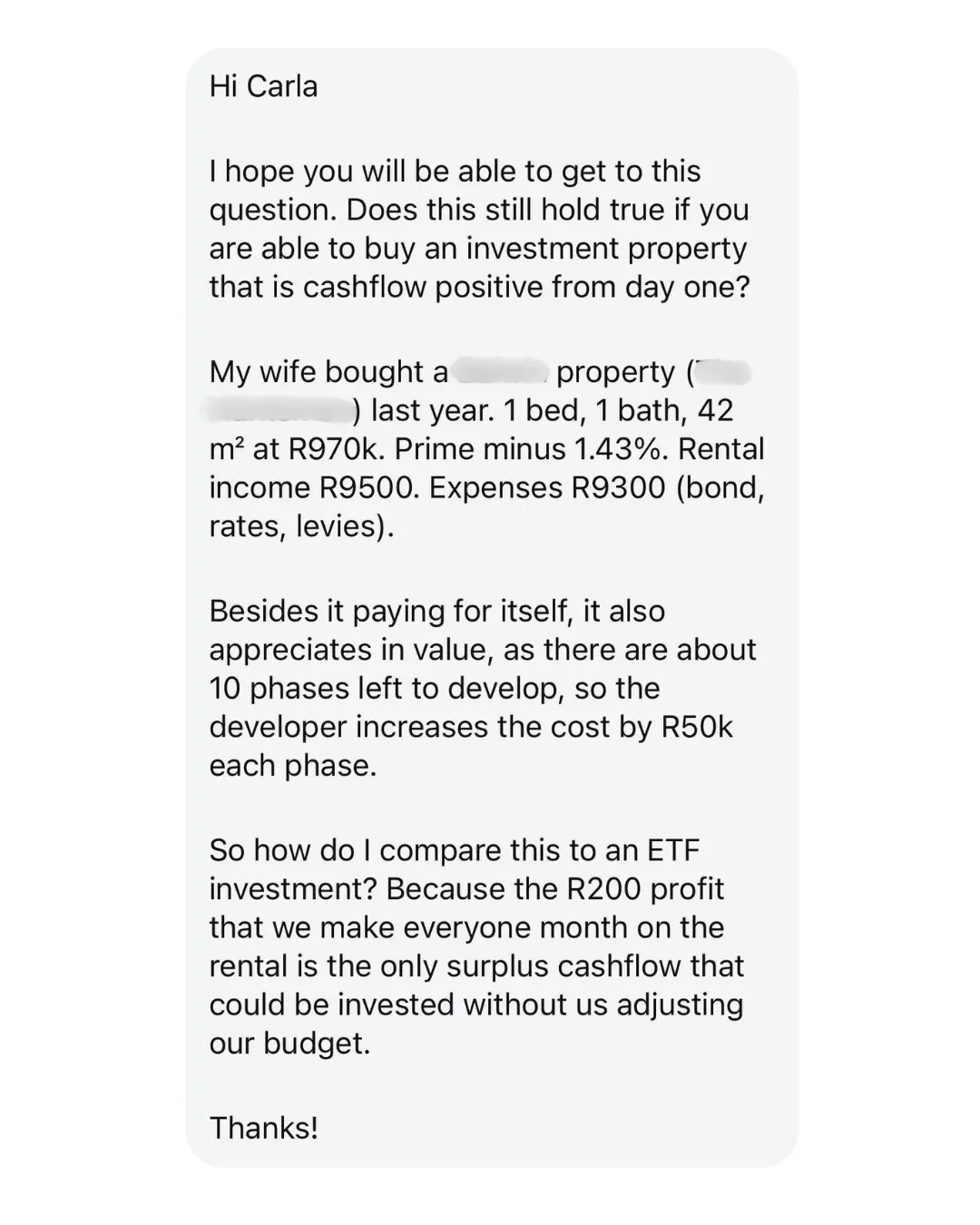

Here’s his DM:

To be honest, I went into this analysis with a bit of bias. Real estate in Cape Town (where this property is located) has been booming, but I am usually not the biggest fan of investing in it. I have done extensive research on real estate, managed the finances for a £600 million portfolio in London, and analysed more than R1 billion worth of property investments in South Africa. I have come close to seeing it all ;)

That being said, I always keep an open mind, and as a woman of numbers, I need to analyse it properly before drawing conclusions.

Note: I had so much fun doing this, I might do it again in the future. If you would like your investments, property, or anything else finance-related analysed, submit your scenario below! I could feature it next.

Here’s the info he shared:

The property was bought at R970k (which is below the transfer duty threshold)

The mortgage is at a rate of prime minus 1.43%

It costs the owner R9’300 per month in rates, levies, and bond payments

Rental income is R9’500 per month, making the property cashflow positive with R200 surplus each month.

This makes it seem like the inflows cover the outflows - but do they?

Here are a few (or many) things I would add to this calculation for completeness' sake:

Tax on rental profit (Only interest payments are tax-deductible, not the entire bond repayment).

Repairs and maintenance provisions (Estimated at 1% of the property value).

Rental agent fees (Which in this case I assume are already taken into consideration, ie, the R9’500 is net of agent fees).

Tenant vacancy and non-payment (Non-payment in this rental bracket is 3.64%, and vacancy in the Western Cape is 1.07%, according to my research).

Insurance, which I included at R300 per month/R3’600 per annum (to be increased in ratio to the value of the property) - but it could be more, depending on the mortgage provider and what they require you to take out.

As for the bond cash flow:

I assumed a 10% deposit.

The interest rate is 9.32% (prime minus 1.43%). Although rates are expected to fall in future and we are on the higher end of the rate cycle, this rate interestingly aligns closely with the 22-year average prime less 1%, according to the South African Reserve Bank’s historic rates.

A 20-year bond is assumed.

Transfer duty is excluded, but other transfer fees and legal fees will need to be considered.

Considering the above, the total initial cash outflow is R164,630.

For future forecasts’ assumptions:

Rental income increases 5.96% (average increase since 2012 in the City of Cape Town, according to PayProp).

Property value increases by 5.99% (average increase over the past 13 years in the City of Cape Town).

For the stock market investments:

12.7% MSCI World return in ZAR (annual average according to Sygnia’s MSCI World ETF, since inception April 2008).

Let’s Get Out the Excel Sheet

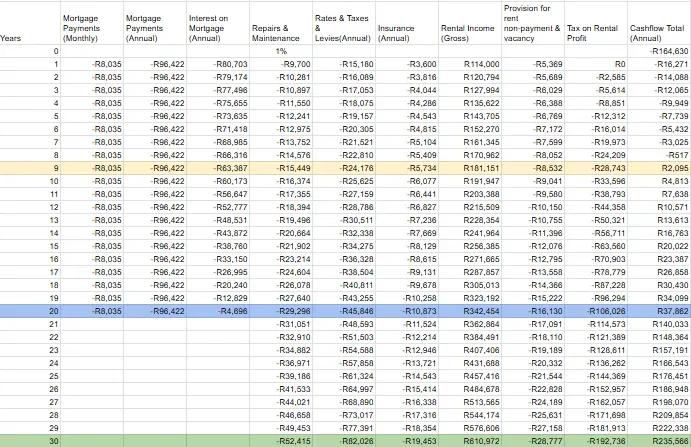

These cashflows projected over 30 years look like below. Notice that years 1 to 8 have negative cashflows:

Now, how do we analyse this?

We’re comparing (1) investing in the property to (2) putting the deposit and initial cash outflows, plus the first 8 years of negative cashflows, into the stock market investment.

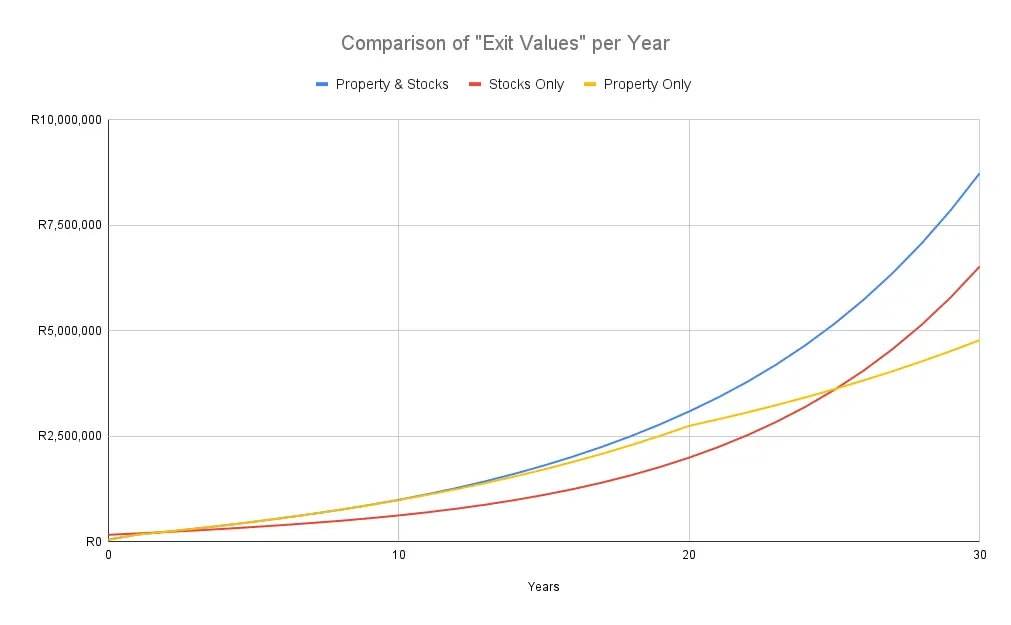

What the property investment could be worth:

In 20 years: R3’1 million

In 30 years: R5’5 million

What the stock market investment could be worth:

In 20 years: R2’3 million

In 30 years: R7’9 million

BUT there are 2 things to consider:

The property investments become cashflow positive in year 9, and this can be invested in the stock market.

There are selling costs and capital gains tax associated with selling the property and stock market investments, and to make this a “fair” comparison, we want to consider the “exit value”.

If you want to see this analysis live in action, watch the accompanying YouTube video.

Who’s the Winner?

So here’s the investment award based on “exit values” - after selling costs and tax:

First prize: The property and stock combo investment (Value of R8’7 million in year 30)

Second prize: Stock portfolio (Value of R6’5 million in year 30)

Last place: Property only (Value of R4’7 million in year 30)

I have to be honest, the results surprised me. I did not expect the property & stock combo to win. But I would say this is an exceptional outcome, specifically because:

Of the “above-average” increase in property value in Cape Town over the last 10 years

The average increase in rental income is higher than the rest of South Africa

The vacancy rate is lower than the rest of SA

And the non-payment provision for the given rental bracket is the lowest of all properties

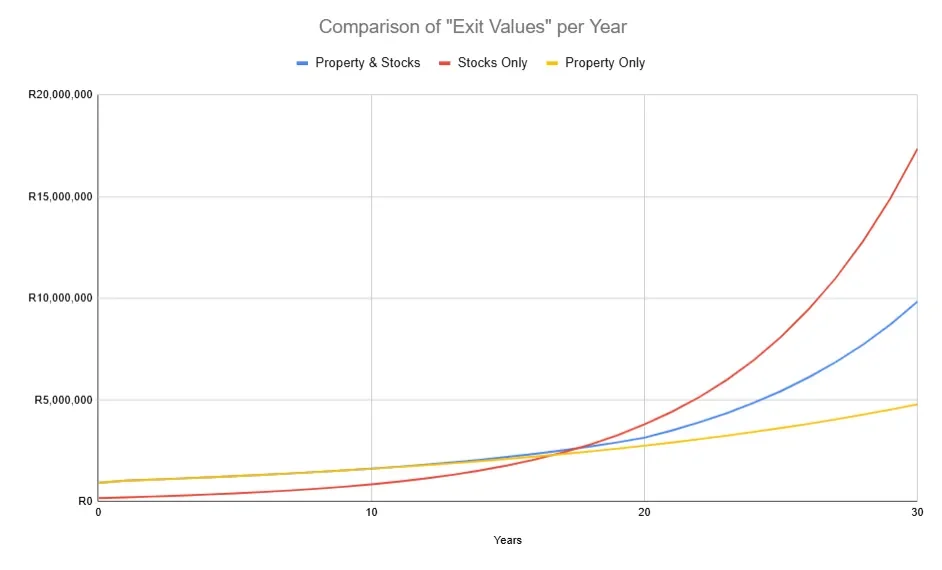

What About My Favourite, the S&P 500?

I want to mention one last comparison: what if the initial cashflows and negative cashflows could've been invested in the S&P 500?

Based on the 10-year average returns of the S&P 500 in ZAR, the hypothetical stock market investment would’ve won first prize.

This outcome relies on the ZAR continuing to depreciate against the USD at 5.5% per year, and the S&P 500 continuing to return 10+% in USD. I am still very much pro-US stock market. But these remain assumptions.

So, did this property change my mind about real estate investments? Not quite yet.

Most of all, property investments are:

Hard work with tenants needing attention, and if an agency takes care of this part, it reduces your return.

Not providing you with as much diversification to hard currency and international economies.

Not really passive investments. My stock portfolio does not need any attention from me, only regular contributions, which can be automated.

Did you find my perspective valuable? Submit your scenario for analysis!

Disclaimer: This is not personalised financial or investment advice but rather for educational purposes. I have made every effort to ensure accuracy, but it cannot be guaranteed. Do your own research before making investment decisions. Capital is at risk when investing. These outcomes are purely based on assumptions made based on past returns, and past returns cannot guarantee future outcomes.